The business structure demonstrates the lengths to which Alberta went to invest taxpayer money in Keystone XL — including up to $7 million in “administration and finance costs” according to a provincial audit. The province made this financial gamble at a time when Alberta Premier Jason Kenney admitted, in an April 2, 2020, speech to the provincial legislature, that the project was already facing significant “political risk.”

The purpose of 2254746 Alberta Sub Ltd., according to the commission’s annual report, was to allow Alberta to help finance the costs of building the U.S. portion of the pipeline, which was meant to massively expand Canadian crude oil exports from Alberta. It would have brought 830,000 barrels per day of crude from Hardisty, Alta., to Steele City, Nebraska.

The project, however, actually left the province on the hook for $1.333 billion, according to Alberta auditor general Doug Wylie. Alberta shared in the financial pain that the company suffered after U.S. President Joe Biden issued an executive order on his first day in office that revoked the pipeline’s permit.

Biden, noting that the planet is facing a climate crisis, said the project would “undermine U.S. climate leadership” and make it harder for Americans to influence other countries to take ambitious climate action.

TC Energy pulled the plug on Keystone XL a few months later in June 2021 and its assets plummeted in value.

![“The paper trail should be there through the whole thing,” he said in an April 26 interview. People looking at corporate registers, he said, shouldn’t have to cross-check their search with company names in annual reports.

When The Narwhal searched for the corporate records in Delaware, it found that 2254746 Alberta Sub Ltd. was assessed on March 2, 2022, as “delinquent” for failing to pay US$386.26 in taxes or file an updated annual report.

Asked about this, the provincial commission’s chief of staff, Lynda Gwilliam, told The Narwhal in an email that the company’s taxes “were initially delayed, but have since been filed with the appropriate bodies.”

Gwilliam did not provide an explanation for the delay, but wrote that its Delaware corporate structure was nothing out of the ordinary.

“For the partnership with TC Energy to build [Keystone XL], the [Alberta Petroleum Marketing Commission] set up companies in both countries, as is a common practice in such situations,” Gwilliam wrote on April 22.

“These companies were utilized to construct the [Keystone XL] project and were in no way a ‘backup plan’ related to any subsequent NAFTA claim.”

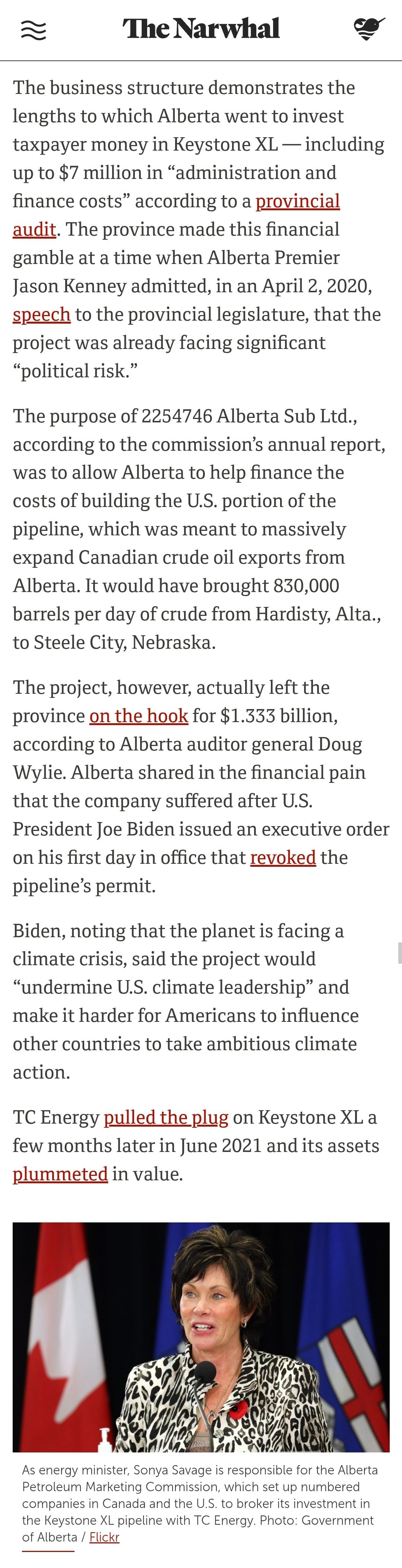

Torso of a man holding a map showing where a pipeline will cross in Montana.

A man displays a printout of where the proposed Keystone XL pipeline would have crossed in Montana. The small circles are locations identified as burial or sacred grounds. Photo: Sara Hylton](https://media.beige.party/media_attachments/files/116/016/509/503/234/740/original/6173eeafff28b270.jpg)