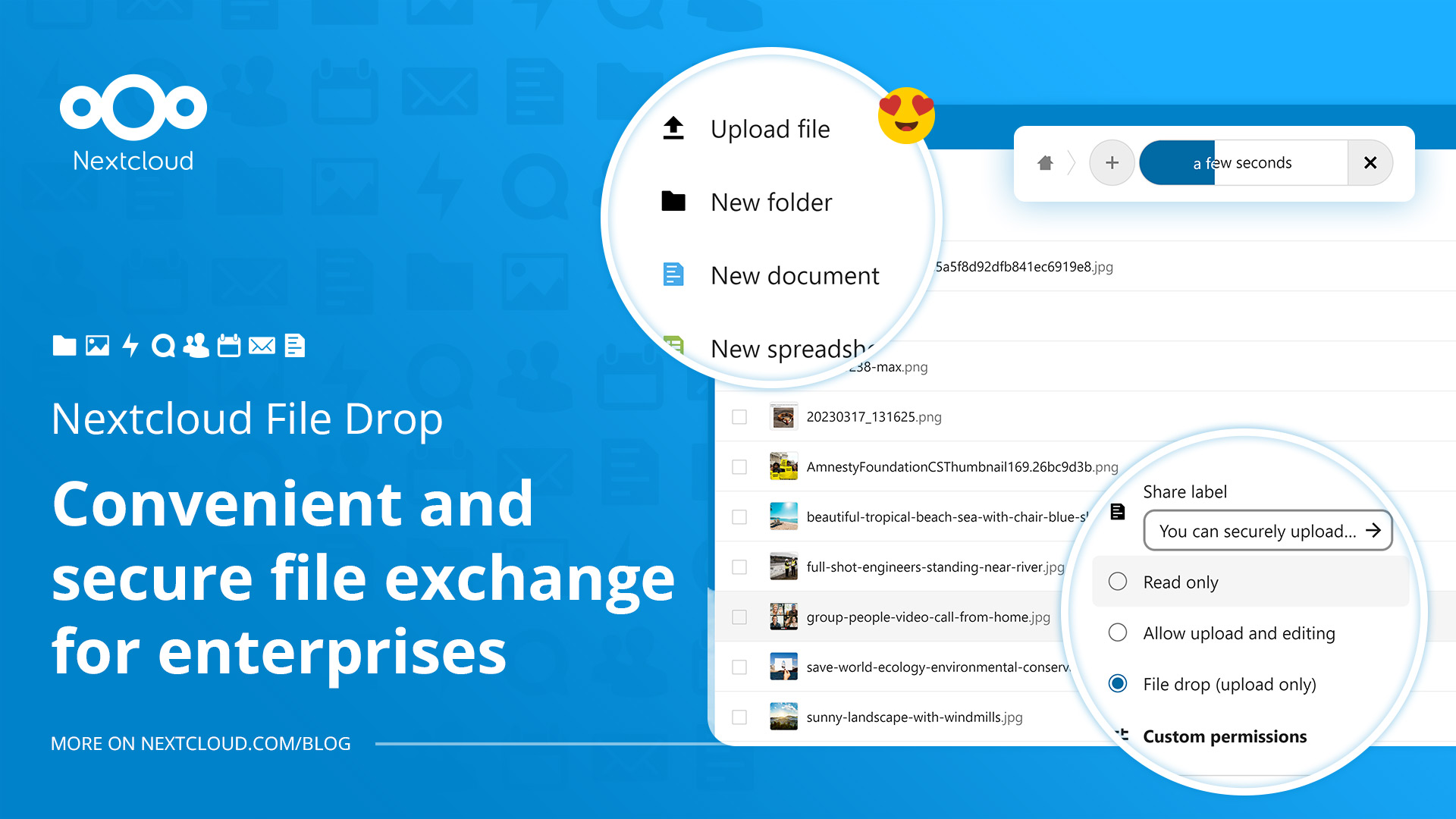

Nextcloud File Drop: convenient and secure file uploading and sharing for Enterprises

Looking for a reliable and secure file upload and share solution? Nextcloud File Drop lets you safely upload & transfer files with confidence!

The post Nextcloud File Drop: convenient and secure file uploading and sharing for Enterprises appeared first on Nextcloud.